Red and black in 2021

In the past year, CBOT US soybeans have experienced several ups and downs. The first is a rapid rise from December 2020 to January this year, mainly due to weather speculation in South America. The winter of 19/20 is the first La Niña year, which usually leads to droughts in South America. Due to concerns about South American production areas, the price of CBOT soybeans has risen sharply. Since February, the weather in the soybean producing areas of South America has gradually stabilized, and there is a lack of hype themes. CBOT soybeans have been sideways for nearly 4 months. Until May, the planting of soybeans in the U.S. began to dominate the market, and the lack of planting area as expected made the market regain the themes of speculation. The continuous monetary easing of the Fed in the previous period caused high inflation in the United States and affected the overall prices of U.S. commodities. At the same time, Brazil's speculation of the second crop of corn in 2021 has given additional support for soybeans, so the CBOT US soybean price has reached an annual high. In early May, as the Federal Reserve began to disclose its plans to reduce debt, U.S. commodities began trading in advance of debt reduction expectations, and in May-June, the South American soybean harvest has a final conclusion, and there is a possibility of pressure on global soybean stocks. Under circumstances, CBOT soybeans opened the way for volatility and decline. Although there have been several rebounds during the long decline in August-November due to fluctuations in weather and per-unit yield speculation, due to the actual pressure on the supply side, especially after the harvest of US soybeans, China has not been aggressive in its purchases. Hit the price. However, after the USDA global soybean supply and demand forecast report was released in November, the situation has changed: due to the low cost performance of the DDGs+lysine formula, the market demand for protein meal has shifted to U.S. soybean meal. The crushing demand of U.S. soybeans is unprecedentedly high, and China's export reduced inventory in the early period. The pressure was filled by the squeeze of U.S. soybeans. CBOT U.S. soybean prices began to rebound. At the end of the year, South American production areas have begun to speculate about the effects of dry weather caused by La Niña. South American soybeans may be expected to reduce yield per unit. The current U.S. soybean prices are still rebounding.

Source: Master Boyi Nanhua Research

Weather and cost are the two major bargaining chips for future prices

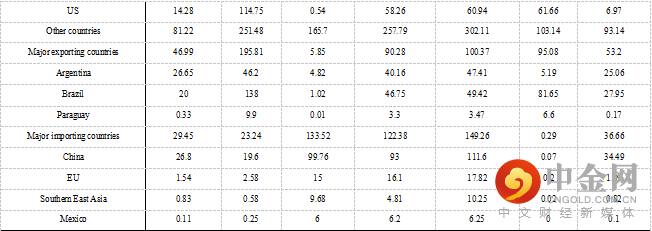

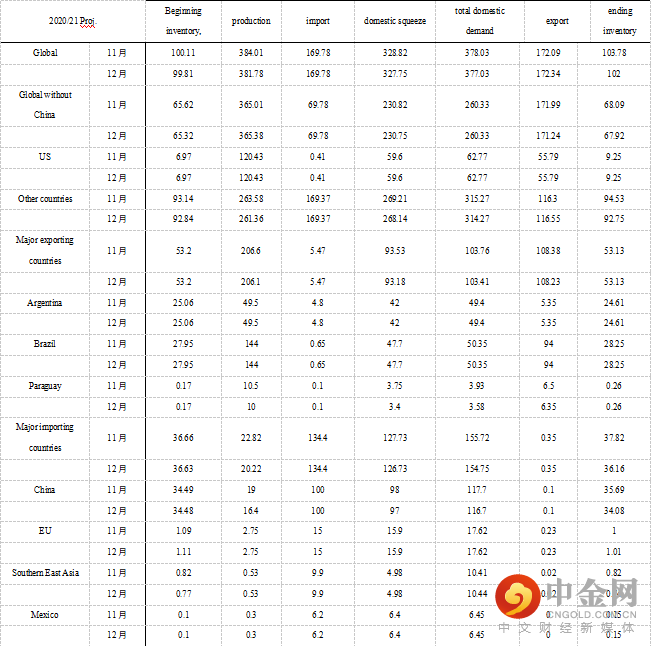

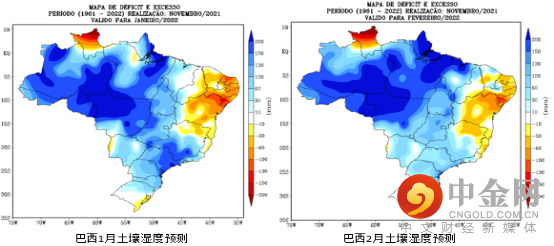

The high yield of US soybeans in 21/22 is already an established fact. According to USDA's global and Chinese soybean supply and demand balance sheet, it can be seen that the supply of soybean oil and soybean meal, the raw material of soybeans, is sufficient, and its global ending inventory is 9549 in 19/20. 10,000 tons is expected to rise to 104 million tons in 20/21. Since the United States basically finished harvesting at the end of the year, its ending inventory pressure performance was greater than that of the other two countries. As for the South American soybeans that have been planted, it can be clearly seen that due to the continuous increase in the probability of forming the La Niña event in the winter of 21/22, the current market is concerned that crop growth may be affected. However, due to the favorable conditions of precipitation in the early stage, the planting of soybeans in Brazil proceeded very smoothly. In particular, the area of newly grown soybeans increased by 5.8% compared with last year. Therefore, the soybeans of South America in the future are also expected to have high yields again. At present, the main factor affecting the yield of soybean crops in South America is the weather in the production area under La Nina climatic conditions. Because this climatic condition generally results in drought and less rain in South America, during the critical period of soybean growth, excessively arid soil moisture will reduce soybean yield Yield. This is also the main driver for the continued rise of CBOT US soybeans at the end of the year.

In terms of import and export trade, the current export situation of U.S. soybeans, which is the pricing standard, is not good. The main reason is that the high prices of U.S. soybeans are constrained by the high price of Brazilian soybeans, and the high inventory of Brazilian soybeans is more cost-effective. USDA's December supply and demand report has not changed from November. It is expected that significant changes will be seen in the January supply and demand report in the future. In particular, there is still greater pressure on inventory expectations.

At present, the U.S. soybean has been harvested, and the output is close to the highest in history. The supply and demand of U.S. soybeans have also shifted from tight to loose. This year's ending inventory will be under greater pressure. According to the USDA supply-demand balance sheet in December, the output of US soybeans is expected to be 114 million tons. The production of soybean oil will also increase due to the loose supply side. The world‘s major soybean oil producers are the United States, Brazil, Argentina, and China. The first three countries are the main soybean producers. China squeezes domestically through imported raw soybeans. Therefore, China It is also a major soybean consumer in the world. China’s 21/22 soybean oil crush is expected to be 17.56 million tons, accounting for more than a quarter of global soybean oil production. my country's soybean oil is mainly consumed domestically. At the end of the year, it entered the traditional peak season for oil and fat consumption, superimposing the current upside-down soybean palm oil price difference. The high cost performance of soybean oil occupies most of the domestic edible oil consumer market.

Figure 2.1: Global soybean supply and demand balance sheet (unit: million tons)

Source: USDA Nanhua Research

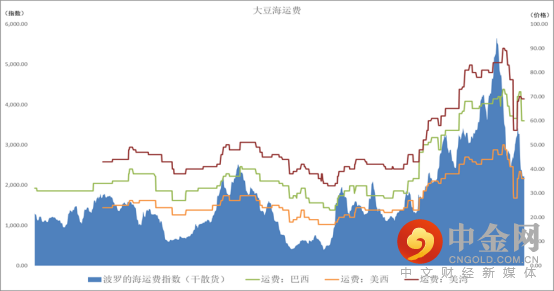

In the early stage, affected by the news of production reduction in the production area, the price of US soybeans has been rising all the way, and the sea freight has been constantly high. The price of domestic imported soybeans has always remained high, and imports have always been negative for disk crush profits. It was not until November that the sea freight eased, and the freight rates of international grain ships began to gradually decrease. Recently affected by the new virus Omicorn, many countries have closed their borders, causing a certain degree of port congestion, and the US shipping line has also faced the problem of large-scale suspension of shipping. Vessels from Meidou's main port of West America to the first line of Asia also need to be diverted, and the express service of the Port of Los Angeles may be suspended for nearly two months. The price of US soybeans, which was expected to be under pressure from North America's high yields, would be difficult to change. It is expected that the port problem in the United States will be resolved, and ocean freight rates will begin to drop significantly. It is expected that it will be the end of the first quarter of next year, when the ocean shipping is off-season.

Source: Wind Nanhua Research

Our view in 2022

Looking forward to 2022, US soybeans will be affected by the lucrative soybean planting in the early stage and the rising cost of corn fertilizer. It is expected that next year, it may be necessary to continue to increase the soybean planting area. It is estimated that by 2022, almost all crop production-related costs will rise, such as fertilizers, pesticides, diesel, maintenance, labor, and even land costs. The biggest increase is currently in chemical fertilizers. Due to the combined effects of high global demand, tight supply, and poor transportation, the prices of several phosphate and potash fertilizers have increased by 15% compared with the third quarter, and the prices of nitrogen fertilizers have increased by nearly 50%. The price of some fertilizers has more than doubled on average year-on-year. Affected by the energy crisis, the high price of crude oil also drove the price of diesel. The price of diesel used in agricultural machinery also increased by more than 50% year-on-year. In addition to increasing input costs of various crops, American farmers will also have to increase the rental cost of land in 2022. According to the average market estimate, the average increase in land rental rates in 2022 is expected to be 10%-20%. Under the current forecast of various planting costs, the break-even point of US soybean prices is about 930 cents. If you include various cost increases, assuming that land costs rise by 10% and investment costs rise by 30%, the break-even point for US soybeans in 2022 will be around 1,230 cents. With the current U.S. soybeans under certain inventory pressure, the increase in planting costs next year will fundamentally raise the prices of U.S. soybeans for the next harvest season.

Source: USDA Nanhua Research

For South America, rising planting costs can be covered by the bumper harvest last year and the expected new high output this year. Take Brazil as an example. The high stocks brought about by Brazil's high production last year have put a lot of pressure on soybean prices. In the early part of this year, due to the combination of weather and precipitation, Brazilian soybeans were planted smoothly and grew well. The market is also continuously increasing the estimated value of soybean production in Brazil for 21/22. Due to the bumper harvest pressure in South America, the price of CBOT US soybeans has been It is also under pressure and difficult to rise; however, due to poor precipitation conditions in the soybean producing areas in southern Brazil and central Argentina, dry and rainless weather for nearly half a month may affect the yield of soybeans. Various agencies are currently in charge of the soybean production in Brazil in 21/22. There are also previous estimates that could reach a record of 144 million tons, which turned into a more cautious 143.7 million tons, but it was still higher than last year's 137 million tons. The first batch of soybeans in Brazil may be harvested as early as mid-January next year. It is estimated that by mid-February, Brazilian farmers are expected to harvest 51 million tons of soybeans, a record high in the same period.

Source: USDA Nanhua Research

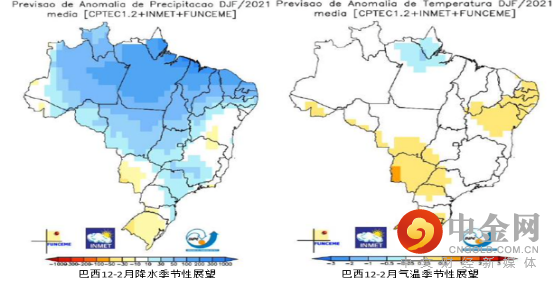

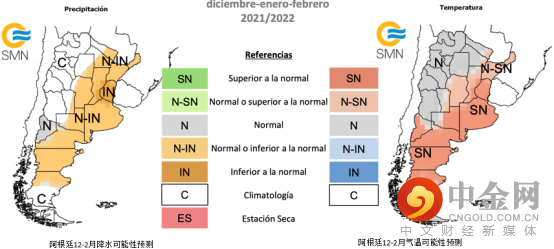

December at the end of the year is a critical period for soybean growth in South America, and it is also an important period for determining soybean yield. According to EC WMF and NWS meteorological models, all agricultural areas in Argentina and Rio Grande do Sul in southern Brazil will be predicted from December to January of the following year. Precipitation in Texas will be slightly lower. According to forecasts from Argentina‘s National Meteorological Agency and Brazil’s National Meteorological Agency, the precipitation in the next two months will be slightly lower than the average level, especially in the southern regions of Brazil, in the states of Rio Grande do Sul and Parana. However, from the perspective of soil moisture, the soil moisture level in southern Brazil will still be relatively good in the next two months, so the consideration of the impact on the soybean production area in South America is relatively limited. In Argentina, it can be seen that the main producing areas in the central part of the central region have slightly less rainfall. The current CBOT soybean market has begun to trade drought impacts. However, due to the limited consideration of the impact of future droughts on production, the current rise is The hype on the weather level may come to an end.

Source: SMN Nanhua Research

Generally speaking, for the future trend of CBOT US soybeans, before North American soybeans are planted, there may be signs of weakening due to the weather hype. The future growth may require other driving factors, such as corn planting and harvesting. , The crush of U.S. soybeans and the profitability of crushed products, and the downward drive requires attention to the Fed‘s response to the actual operation of interest rate hikes on the U.S. dollar index, as well as next year’s macroeconomic level of commodities, especially agricultural products. expected. In terms of the urgency of various factors, our outlook for the price trend of US soybeans in the coming year is that US soybeans may be weaker in the first and second quarters. The core factors of this trend are global soybean stocks and the sowing of US soybeans in the new season. area. In the second half of the year, due to the uncertainty of weather disturbances and the strong increase in planting costs, the trend in the second half of the year may be slightly stronger. Considering that the overall global oilseed volume will be gradually loosened, the CBOT US soybeans will be released next year. The half-year strengthening considerations will also be limited, but the potential increase in consumption of the downstream U.S. soybean oil from U.S. soybean oil at the biodiesel end and the increase in planting costs will give U.S. soybeans a certain price bottom.