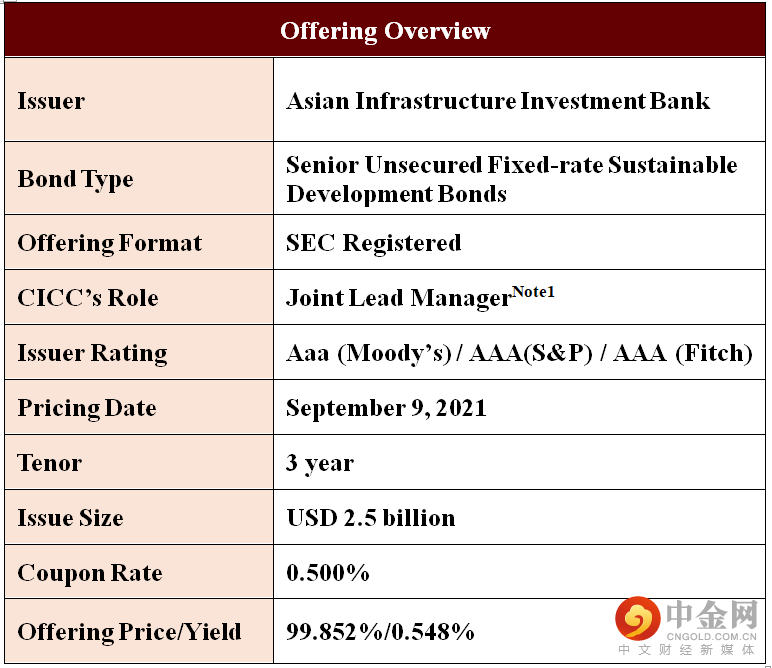

On September 9th, the Asian Infrastructure Investment Bank (AIIB) priced a new USD 2.5 billion SEC Registered Global Sustainable Development Bond 3-year benchmark transaction due October 2024. The transaction priced at SOFR MS + 16bps, equivalent to a reoffer yield of 0.548% and spread of 11.8bps versus CT3. CICC acted as the Joint Lead Manager of this transaction.

Note 1: There is no JGC role in the transactio

As the only Chinese Joint Lead Manager among all the underwriters, CICC was able to utilize its excellent communication and outstanding service capacity to assist AIIB in securing orders from Asian investors, which help to increase participation from Asian investors and construct a diverse investor portfolio for AIIB. CICCs contribution was highly appraised by the client. The orderbook closed in excess of USD 4.4 billion comprised of nearly 70 orders, with strong support from official institutions and bank treasuries.

Demonstrating its leadership as a frequent borrower in the capital markets, this transacti

on represented the first time that AIIB marketed an USD-denominated fixed-rate benchmark transaction versus the new SOFR MS reference. With this transaction, AIIB has become one of the earliest SSA issuers to adopt the new reference rate in marketing a fixed-rate transaction.

The transaction represents AIIB‘s fourth benchmark-size bond issue of 2021. The proceeds of the issuance will be used to foster sustainable economic development, create wealth and improve infrastructure connectivity in Asia by investing in infrastructure and other productive sectors and promote regional cooperation and partnership in addressing development challenges by working in close collaboration with other multilateral and bilateral development institutions. This Sustainable Development Bond benchmark also highlights AIIB’s firm commitment to integrate environmental and social sustainability into its mandate, helping it finance Infrastructure for Tomorrow in its members by focusing on (1) Green Infrastructure, (2) Connectivity and Regional Cooperation, (3) Technology-enabled Infrastructure and (4) Private Capital Mobilization.

This transaction is another successful collaboration between AIIB and CICC in the debt capital market, following the debut issuance of AIIB‘s Panda bond in 2020, which demonstrates CICC’s outstanding capacity to serve clients in both onshore and offshore capital markets. This is another milestone transaction for CICCs international strategy and its commitment to serve International multilateral institutions.