The price of gold has been under pressure since the beginning of the week after rising to a one-month high of 1,834 per ounce.

Thi

decline can be explained by a rebound of the dollar after falling to a

low of more than a month last week following disappointing U.S. economic

statistics that call into question the Fed's tapering outlook.

Indeed,

several sets of statistics came in below expectations in recent weeks,

including the monthly jobs report, which showed only 235,000 jobs

created in August, versus 750,000 expected.

I

addition to the rebound in the dollar, the gold price is also under

pressure due to the rise in real rates for nearly a month. The real

yield on the US 10-year Treasury bond rose from a low of -1.19% on

August 3 to -0.98% on September 6, improving the attractiveness of the

US bond market and thus putting pressure on alternative "safe haven"

assets like gold.

The

JOLTS jobs report and the Fed's Beige Book released on Wednesday are

expected to be particularly important for investors' outlook on the

economy, the Fed's monetary policy, and thus the financial markets. A

Beige Book showing an overheating economy would fuel the tapering

outlook, while a report showing slowing domestic demand would further

discount the tapering outlook.

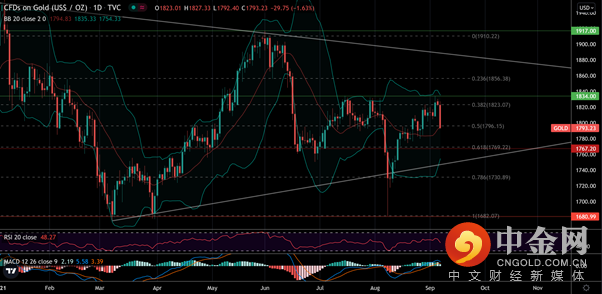

From

a technical perspective, gold is retreating from a key resistance at

1,834 correspondings to the early July high below which gold had already

retreated in late July. Although the trend is short-term bullish, the

risk/reward ratio does not favor buying strategies below this

resistance. It will be preferable to wait for a breakout or a

retracement before looking to buy.

The

risk/reward ratio is currently in favor of sellers. A pullback below

Friday's low of about 1,808 would pave the way for a retracement of the

recent bullish rally. A return to the pivot at 1,755 would then be

expected in the short term.

(Chart Source: Tradingview 07.09.2021)

If

the price rebounds and breaks above the resistance at 1,834, the

outlook would be bullish again in the short term and a return to the

June high at 1,916 could be expected.

Disclaimer:

This material has been created for information purposes only. All view

expressed in this document are my own and do not necessarily represent

the opinions of any entity.