The ounce of gold underwent a major sell-off on Friday and Sunday night. The ounce of gold fell nearly 10% in less than two sessions after the release of a strong U.S. jobs report raised fears that the Federal Reserve would begin to reduce its asset purchases sooner than expected.

Indeed, the highly anticipated jobs report showed that 943,000 jobs were created in July, the most since August 2020, while the consensus was for 870,000. The unemployment rate fell more than expected to 5.4% and average hourly earnings rose more than expected, by 0.4%.

Gold prices have been trying to reverse the trend since Monday by rebounding back towards $1,750 after hitting a yearly low of $1,675. The outlook for gold remains bearish, however, in the absence of disappointing macroeconomic data that would challenge the Fed's rapid tapering scenario.

The next major catalyst for the financial markets will be the interventions of central bankers at the Jackson Hole symposium at the end of the month, in particular, that of Jerome Powell. The Fed Chairman may moderate his dovish tone following the very good jobs report.

Nevertheless, although the employment report was very good, it will have to be confirmed by a second one to really consider a Fed tapering in the fourth quarter. In the event of a disappointing report in September, it is very likely that the FOMC will wait longer before reducing its asset purchases.

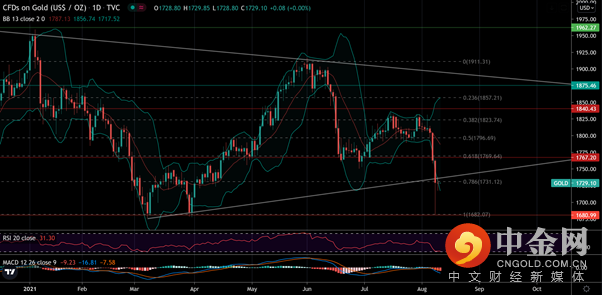

From a technical perspective, the outlook for gold prices has turned bearish again since last week after it breached its support at $1789 and its bullish moving average running through the June and July lows.

However, the daily candlestick being formed Monday signals caution for bears. Buyers seem to be regaining control after capitulating the previous session, as evidenced by the large bearish wick.

While a close below the pivot at $1,755 would open the way for a continuation of the decline to the year's low tested overnight at $1,675, the rest of the decline could be much slower given the renewed appetite of buyers.

(Chart Source: Tradingview 10.08.2021)

The price of gold will have to consolidate and then rebound in order to regain a bullish outlook. Technically, it will probably be best to wait for a break above the recent high of $1,834 before counting on a bullish reversal in gold in the medium term.

Disclaimer: This material has been created for information purposes only. All views expressed in this document are my own and do not necessarily represent the opinions of any entity.